BJP’s coalition partners were the reason they could form the government’s Inclusive Economic Growth. Because of this, many people are saying that this budget has become the infrastructure budget for Andhra Pradesh and Bihar.

The government announced that they would spend crores on Bihar’s road network, creating expressways in Patna, Purnia, and Bhagalpur, and building a two-lane bridge over the Ganges in Buxar.

We can only hope that the government chooses at least a decent contractor this time. If you look closely at this budget, the Modi government has taken a conservative approach.

Their main fear is the fiscal deficit, which they want to reduce. A target that was once 5.1% of GDP is now 4.9%. The government has decided to save money now and perhaps spend it in the future, as they believe India’s consumption will increase.

Seeing this, urban taxpayers are angry because tax rates have not been reduced, capital gains tax has increased, and taxation benefits have been removed.

What are we getting in return? There is some criticism that I completely disagree with. Nowadays, it’s become a trend on social media for everyone to call themselves middle class.

In February 2020, at a CNBC award function, the then Chief Minister of Maharashtra, Uddhav Thackeray, gave a speech that went viral.

He said that a successful finance minister is the one whose pocket is picked, and he doesn’t even realise which pocket was picked. So, could Finance Minister Nirmala Sitharaman

achieve this in this budget? In this article, I will discuss why people are angry with this budget and what impact it will have on our country.

Now, let’s discuss the budget.

The standard deduction has been reduced. The standard deduction is the amount you can subtract from your income, on which you don’t have to pay any income tax.

It has been increased from 50,000 to 75,000. After this, several income tax slabs have also been changed. So, what benefit will people get from this? Very little.

As a result of this change, a salaried employee in the new tax regime stands to save up to 7,500 in income tax. Under the new tax regime, the maximum benefit you will get is 17,500, and no change has been made in the old tax regime, so you won’t get any benefit.

Sometimes, the mood of consumers also matters in increasing private consumption, but unfortunately, the mood has soured because there hasn’t been much change in income tax.

Moreover, several other taxes have been increased in the stock market, such as short-term capital gains tax.

It is being declared that tax authorities have a GDP twenty times greater than what is being reported, meaning people are misusing the system to avoid paying taxes.

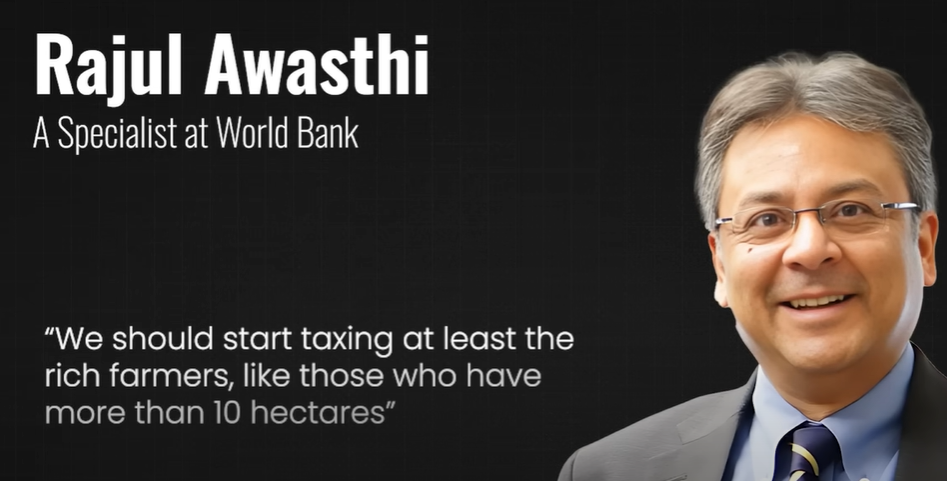

This is why Raju Awasthi,

a specialist at the World Bank said we should tax rich farmers, such as those with more than 10 hectares of land.

Tax should be based on income, whether it is from agriculture or elsewhere. However, there is some criticism that I completely disagree with. Nowadays, it’s become a trend on social media for everyone to call themselves middle class.

This is why the driver who is driving the car also considers himself middle class, and so does the boss sitting in the back. Even though the average monthly salary in Indian cities is only 20,000, those earning 2 lakh also call themselves middle class.

One thing we must acknowledge is that urban governance issues are not being addressed. Playing identity politics might get votes, but cities do not improve.

The government has certainly mentioned urban infrastructure in its budget, saying it wants to make cities grow hubs with better transportation.

They also said they would improve water supply, sewage treatment, and waste management in 100 major cities.

Announcing this is a good step, but an easy step; execution will be difficult, and only then will we know if taxpayers are getting anything in return.

Another reason urban taxpayers are so angry is that there is a tax on the salaried class but not on agricultural income. Why is that, it’s a valid question.

A few years ago, an RTI revealed that while agricultural growth was 3-5%,

some agricultural incomes had increased by 10-125%. Many investors are naturally unhappy.

Additionally, securities transaction tax on futures and options has also been increased. People are angry with these changes, but if you’ve read recent statements from SEBI or the Finance Ministry, it shouldn’t be so surprising.

The day before the budget was released, the government’s economic survey said that the Indian market had become over-financialised, meaning Indian families were putting too much of their savings into the stock market, which the government feared.

They felt the stock market was overheating. Moreover, it is an open secret that options trading in the Indian market is crazy. Many people use options and futures for hedging their trades.

You will have to pay tax on 10 out of 10 lakhs. Now, it is true that the tax rate has decreased from 10 to 125.

If you earn 1 lakh rupees, you will now have to pay a tax of 10,000 rupees. The tax rate has indeed decreased from 15% to 10%. While the government claims that this will encourage people to save, the truth is that it will discourage people from investing in the stock market.

If the government had allowed capital gains tax to remain unchanged, people would have invested their savings in the stock market.

This could have led to a bubble in the market, which might eventually burst. This is why the government has chosen to save money now, with the hope of spending it in the future, when they believe consumption will increase in India.

In addition to this, the government has not made significant changes to tax slabs. While the standard deduction has been increased from 50,000 to 75,000 rupees, the impact on taxpayers is minimal.

A salaried employee in the new tax regime stands to save up to 7,500 rupees in income tax. The maximum benefit one can receive is 17,500 rupees, and there are no changes in the old tax regime. Consequently, there is little benefit for taxpayers.

Consumer sentiment also plays a role in increasing private consumption, and unfortunately, this sentiment has soured due to the lack of substantial changes in income tax.

Additionally, several other taxes in the stock market have increased, such as the short-term capital gains tax.

Another issue is the disparity in taxation between the salaried class and agricultural income. Many urban taxpayers are angry that while they have to pay taxes, agricultural income remains untaxed.

This is a valid concern, especially when some agricultural incomes have reportedly increased by 10-125%, despite agricultural growth being only 3-5%.

Urban governance issues are also being neglected. While identity politics might garner votes, cities do not see improvement.

The government has mentioned urban infrastructure in its budget, aiming to make cities grow hubs with better transportation.

They have also promised to improve water supply, sewage treatment, and waste management in 100 major cities.

Announcing these plans is a good step, but execution will be challenging. Only then will taxpayers know if they are receiving value in return?

Many investors are naturally unhappy with the increase in the securities transaction tax on futures and options.

However, this should not come as a surprise if one has been following recent statements from SEBI or the Finance Ministry.

The government’s economic survey highlighted that the Indian market has become over-financialised, meaning Indian families are putting too much of their savings into the stock market.

The government feared the stock market was overheating, which is why they made these changes.

Options trading in the Indian market is particularly crazy, with many people using options and futures for hedging their trades.

In summary, this budget has taken a conservative approach, focusing on reducing the fiscal deficit and saving money now with the hope of spending it in the future.

Urban taxpayers are dissatisfied with the minimal changes in income tax and the increase in other taxes.

The disparity in taxation between the salaried class and agricultural income, as well as the neglect of urban governance issues, are also significant concerns.

The government’s conservative approach may be strategic, but it has not been well-received by the public.

Growing Concerns Over Government Spending Transparency

Another significant concern for taxpayers is the lack of substantial benefits or incentives for the middle class. The government’s focus on infrastructure and rural development, while necessary, has not translated into immediate relief or benefits for urban taxpayers.

The increase in the standard deduction and minor adjustments in tax slabs do not suffice to address the rising cost of living and inflation that the middle class faces daily.

Additionally, there is a growing frustration over the lack of transparency and accountability in government spending. People are questioning where their tax money is going and how effectively it is being utilised.

The promises of improved urban infrastructure, better transportation, and enhanced public services are yet to be realised, and taxpayers are demanding more concrete results.

The agricultural sector continues to be a contentious issue. While it is crucial to support farmers and rural development, the exemption of agricultural income from tax is seen as an unfair advantage.

This has led to calls for a more balanced approach to taxation, where high-income agricultural earners are also brought into the tax net.

This would ensure a fair distribution of the tax burden and address the growing discontent among urban taxpayers.

Another area of concern is the government’s approach to handling the fiscal deficit. While reducing the deficit is a prudent move, it should not come at the expense of essential public services and welfare schemes.

The government’s decision to cut down on spending in certain areas has raised fears about the impact on social services, healthcare, and education.

These sectors are critical for the overall well-being of the population, and any reduction in funding could have long-term negative consequences.

The introduction of new taxes and the increase in existing ones, particularly in the stock market, have also been met with resistance.

Investors and traders are feeling the pinch, and there is a growing concern that these measures could stifle market growth and discourage investment.

The government’s attempt to control the overheating of the stock market is understandable, but it needs to strike a balance to ensure that it does not adversely affect investor confidence and market stability.

On the political front, the budget has been criticised for favouring certain states over others. The significant allocation for infrastructure development in states like Andhra Pradesh and Bihar has raised eyebrows and led to accusations of political bias.

While these states do need development, the perception of partiality can create a sense of regional disparity and alienate other states that feel neglected.

Overall, the 2024 budget has sparked a mixed reaction. While some applaud the government’s focus on infrastructure and fiscal prudence, many are left disappointed with the lack of immediate relief and benefits for the middle class and urban taxpayers.

The concerns about transparency, fairness in taxation, and the impact on public services need to be addressed to restore public confidence and ensure balanced economic growth.

In conclusion, the Modi government has taken a cautious and conservative approach to the 2024 budget, aiming to reduce the fiscal deficit and lay the groundwork for future growth.

However, this approach has not resonated well with urban taxpayers and investors, who are looking for more immediate relief and benefits.

The government must address these concerns and ensure that the promised improvements in infrastructure and public services are realised to regain public trust and support.

The focus should be on creating a more balanced and inclusive budget that addresses the needs of all sections of society while maintaining fiscal discipline.

One of the most pressing issues that the budget has failed to address adequately is the rising unemployment rate.

The pandemic has left a significant impact on the job market, and many people are still struggling to find stable employment.

The budget’s focus on infrastructure projects could potentially create jobs in the long run, but there is a need for immediate measures to support those who are currently unemployed or underemployed.

Skills development programmes, vocational training, and incentives for small and medium enterprises (SMEs) to hire more staff could help bridge this gap.

Another area where the budget falls short is in its support for the healthcare sector.

The pandemic has underscored the importance of a robust healthcare system, yet the budget does not allocate sufficient funds to improve healthcare infrastructure, increase the number of healthcare professionals, or provide better access to medical services.

With the ongoing threat of future health crises, investing in healthcare should be a top priority to ensure that the country is better prepared to handle such situations.

Education is another critical sector that requires more attention. The budget does mention improving education infrastructure, but the allocations are not enough to address the systemic issues that plague the sector.

There is a need for more substantial investment in teacher training, digital education tools, and the development of a curriculum that meets the demands of the modern job market.

Ensuring that students have access to quality education, regardless of their socio-economic background, is essential for the country’s long-term growth and development.

The budget’s emphasis on infrastructure development, while commendable, should also consider the environmental impact of such projects.

Sustainable development is crucial in the face of climate change, and the government needs to ensure that infrastructure projects are environmentally friendly and do not lead to long-term ecological damage.

Investing in renewable energy, promoting green technologies, and implementing stricter environmental regulations can help balance development with sustainability.

The concerns of the youth also need to be addressed. Young people are the future of the country, and their aspirations and needs must be taken into account.

The budget should include more initiatives aimed at empowering the youth, such as startup incubators, entrepreneurship programmes, and support for innovation and research.

Encouraging young entrepreneurs and providing them with the necessary resources and support can drive economic growth and create new opportunities.

The government must also work towards improving transparency and accountability in its financial dealings.

There have been numerous instances of public funds being misused or projects being delayed due to bureaucratic inefficiencies and corruption.

Strengthening institutions, implementing stricter oversight mechanisms, and ensuring that public money is spent efficiently can help build trust and confidence among taxpayers.

On a positive note, the budget does lay the groundwork for long-term economic growth by focusing on infrastructure and reducing the fiscal deficit.

However, these measures need to be complemented with policies that address the immediate concerns of the population.

Ensuring that the benefits of economic growth are distributed equitably across all sections of society is essential for maintaining social harmony and political stability.

The government should also consider revisiting its approach to taxation. While it is crucial to maintain fiscal discipline, there needs to be a balance that does not overly burden any particular section of society.

Progressive taxation, where the tax rate increases with income, could be a more equitable approach. Additionally, simplifying the tax code and making it more transparent can help reduce tax evasion and increase compliance.

In summary, while the 2024 budget has taken some important steps towards fiscal prudence and infrastructure development, it falls short in addressing the immediate needs of the urban middle class, healthcare, education, and unemployment.

The government must take a more balanced and inclusive approach to ensure that the benefits of economic growth reach all sections of society. By addressing these concerns and implementing effective policies, the government can build a stronger, more resilient economy that works for everyone.

Strengthening Social Welfare and Empowering Vulnerable Groups

To achieve a more inclusive budget, the government must also focus on social welfare programmes. Strengthening the social safety net is essential to protect the most vulnerable sections of society.

Increasing funding for programmes such as the Public Distribution System (PDS), Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), and other welfare schemes can provide immediate relief to those in need.

Ensuring that these programmes are efficiently managed and free from corruption will enhance their effectiveness and reach.

Additionally, the government should prioritise the empowerment of women and marginalised communities. Despite significant progress over the years, women and certain social groups continue to face economic and social barriers.

Policies aimed at promoting gender equality, providing financial support to women entrepreneurs, and ensuring equal opportunities in education and employment can help bridge these gaps. Special focus should be given to creating a more inclusive job market and supporting women in leadership roles.

Rural development remains a critical area that requires sustained investment. While the budget has made provisions for infrastructure development in rural areas, more needs to be done to improve the overall quality of life in these regions.

Investing in rural healthcare, education, and sanitation can have a profound impact on reducing rural-urban migration and ensuring balanced regional development. Promoting agro-based industries and providing better market access for farmers can also enhance rural incomes and economic stability.

The government’s push for digitalisation and technological advancement is commendable, but it must ensure that the benefits of these advancements are accessible to all.

Bridging the digital divide by improving internet connectivity in remote areas, providing digital literacy programmes, and making technology affordable can empower more people to participate in the digital economy. Encouraging innovation and supporting tech startups can also drive economic growth and create new job opportunities.

Addressing environmental challenges is another critical area that requires urgent attention. The effects of climate change are becoming increasingly evident, and the government must prioritise sustainable development.

Investing in renewable energy sources, promoting energy efficiency, and implementing robust environmental regulations can help mitigate the impact of climate change. Encouraging sustainable agricultural practices and reducing pollution levels are also essential steps towards creating a healthier environment.

Furthermore, the government should engage in meaningful dialogue with various stakeholders, including industry leaders, economists, and civil society organisations, to ensure that the budget reflects the diverse needs of the population.

Transparent and inclusive policy-making processes can build public trust and create a sense of ownership among citizens. Regular feedback mechanisms and performance reviews of budgetary allocations can also help in making necessary adjustments and improvements.

To summarise, while the 2024 budget has laid a foundation for long-term economic growth through infrastructure development and fiscal prudence, it must also address the immediate needs and concerns of the population.

By focusing on social welfare, healthcare, education, employment, gender equality, rural development, digitalisation, environmental sustainability, and inclusive policy-making, the government can create a more balanced and equitable budget.

Ensuring that the benefits of economic growth reach all sections of society will contribute to a stronger, more resilient economy and a harmonious society.

The challenges ahead are significant, but with the right policies and a commitment to inclusive growth, the government can navigate these challenges effectively. Building a prosperous future requires collaboration, innovation, and a focus on the well-being of every citizen.

By addressing the gaps and shortcomings in the current budget, the government can take meaningful steps towards achieving these goals and creating a brighter future for all.

Investing in Human Capital and Sustainable Development

One of the key components for achieving a prosperous and equitable future is investing in human capital. This means prioritising education, healthcare, and skills development to ensure that every citizen has the opportunity to contribute to and benefit from economic growth.

In education, the government should increase funding not only for infrastructure but also for teacher training and curriculum development.

Emphasising STEM (Science, Technology, Engineering, and Mathematics) education, as well as vocational training, can equip students with the skills needed for the jobs of the future. Scholarships and financial aid programmes should be expanded to ensure that students from all socio-economic backgrounds can access quality education.

In healthcare, addressing the disparities between urban and rural areas is crucial. Investments in rural healthcare infrastructure, increasing the number of healthcare professionals, and providing incentives for doctors to work in underserved areas can help bridge this gap.

Additionally, the government should focus on preventive healthcare measures and public health campaigns to improve overall health outcomes and reduce the burden on the healthcare system.

Skills development and lifelong learning are also vital in a rapidly changing job market. The government should promote continuous education and training programmes to help workers adapt to new technologies and industries.

Collaboration with the private sector can ensure that these programmes are aligned with market needs and that there are ample opportunities for internships and apprenticeships.

Furthermore, the government must address housing affordability and urban development. With increasing urbanisation, there is a growing need for affordable housing and improved urban infrastructure.

The budget should allocate funds for the construction of affordable housing units and the development of smart cities with efficient public transport, green spaces, and sustainable practices.

These initiatives can improve the quality of life in urban areas and make cities more livable and environmentally friendly.

The importance of a robust social security system cannot be overstated.

Expanding social security coverage to include more informal sector workers, providing unemployment benefits, and ensuring pension security for the elderly are essential steps towards creating a safety net for all citizens.

Strengthening these systems can protect individuals and families from economic shocks and provide stability during times of crisis.

In addition to domestic policies, the government should also focus on international trade and relations to boost economic growth.

Strengthening trade partnerships, participating in global value chains, and negotiating favourable trade agreements can open up new markets for Indian products and services.

Export promotion and support for small and medium enterprises (SMEs) in accessing international markets can drive economic growth and create jobs.

The role of technology and innovation in driving economic growth cannot be ignored. The government should continue to support research and development (R&D) and promote innovation through grants, tax incentives, and public-private partnerships.

Creating innovation hubs and fostering a culture of entrepreneurship can spur technological advancements and make India a leader in various high-tech industries.

Finally, fostering a culture of good governance and accountability is essential for effective policy implementation. The government must ensure transparency in its operations, reduce bureaucratic red tape, and combat corruption.

Leveraging technology to improve public service delivery, such as through digital governance platforms, can enhance efficiency and ensure that government programmes reach their intended beneficiaries.

In conclusion, while the 2024 budget sets the stage for future economic growth through infrastructure development and fiscal prudence, a more comprehensive approach is needed to address the immediate needs of the population and ensure inclusive growth.

By focusing on human capital development, social security, healthcare, education, housing, skills development, international trade, technology, and good governance, the government can create a balanced and equitable budget that benefits all citizens.

The path to a prosperous and equitable future requires strategic investments, inclusive policies, and a commitment to the well-being of every individual.

Promoting Inclusive Economic Growth and Regional Development

The government’s focus on improving infrastructure is a significant step, but it must also ensure that these projects are implemented efficiently and transparently. Proper planning, timely execution, and regular monitoring are crucial to avoid delays and cost overruns.

Public-private partnerships (PPPs) can play a pivotal role in this regard, bringing in private sector expertise and investment to complement government efforts.

Energy security is another vital area that requires attention. As the economy grows, the energy demand will increase. The government should invest in a mix of energy sources, including renewable energy, to meet this demand sustainably.

Promoting solar, wind and other renewable energy projects can reduce dependence on fossil fuels and help combat climate change. Additionally, improving energy efficiency in industries and households can lead to significant cost savings and environmental benefits.

The agricultural sector, despite its importance, often does not receive the attention it deserves. The government should implement policies that support sustainable agricultural practices, improve irrigation infrastructure, and provide farmers with access to modern technology and credit facilities.

Ensuring fair prices for agricultural produce and expanding market access can improve farmers’ incomes and livelihoods. Moreover, promoting agro-processing industries can add value to agricultural products and create rural employment opportunities.

Financial inclusion is another critical aspect of inclusive growth. Ensuring that all citizens have access to financial services, such as banking, insurance, and credit, can empower them economically.

The government should continue to promote digital payments and fintech innovations to make financial services more accessible and affordable. Strengthening financial literacy programmes can also help people make informed financial decisions and improve their economic well-being.

The role of small and medium enterprises (SMEs) in the economy cannot be overlooked. SMEs are significant contributors to employment and economic activity. The government should provide support to SMEs through easier access to credit, simplified regulatory processes, and incentives for innovation and expansion.

Creating a conducive environment for SMEs can drive entrepreneurship and foster economic resilience.

Tourism is another sector with immense growth potential. Promoting tourism can create jobs, boost local economies, and enhance the country’s cultural heritage.

Investing in tourism infrastructure, such as hotels, transportation, and tourist attractions, and launching international marketing campaigns can attract more visitors to India.

Additionally, developing niche tourism segments, such as eco-tourism, adventure tourism, and cultural tourism, can diversify the tourism industry and attract different types of travellers.

Addressing regional disparities is crucial for balanced economic development. Some states and regions lag in economic growth and development indicators.

The government should implement targeted policies to support lagging regions, such as special economic zones (SEZs), infrastructure projects, and incentives for businesses to invest in these areas. Ensuring that all regions have access to basic services, such as healthcare, education, and clean water, is essential for inclusive growth.

The government must also focus on creating a more inclusive society by addressing social inequalities. This includes promoting policies that ensure equal opportunities for all, regardless of gender, caste, religion, or socio-economic background.

Affirmative action, social justice programmes, and community development initiatives can help bridge social divides and create a more equitable society.

In conclusion, the 2024 budget has laid the groundwork for future economic growth, but it must be accompanied by comprehensive policies that address immediate needs and promote inclusive development.

By focusing on human capital, social welfare, healthcare, education, skills development, energy security, sustainable agriculture, financial inclusion, support for SMEs, tourism, regional development, and social equity, the government can create a balanced and equitable budget.

Ensuring that the benefits of economic growth reach all sections of society is crucial for building a strong, resilient, and prosperous nation.